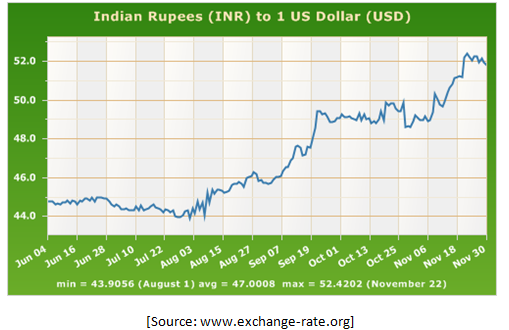

Rupee’s worth is at an all-time low! The US Dollar (USD) to Indian Rupee (INR) exchange rate on November 22 was highest ever: 52.42 – almost 19% – 2nd highest drop in recent history. I’m not an economist. However, the numbers do not make sense. My common sense tells me that India’s GDP growth rate is steady and much higher compared to the rest of the world except China. What could be the reasons behind this fall?

Some have given reasons such as broad gains in dollar overseas due to the decay of euro, huge demand from domestic oil refiners with growing consumer demand for oil (though many argue that falling oil price could be advantageous to rupee). I also have heard of other factors such as disinvestment ( foreign investment has gone done almost by 50% today compared to 2007-2008 period – perhaps due to the corrupt image of Indian economy), slowing down of export, growing current trade account deficit (it has grown almost 3 times since 2007-2008). All these could be valid reasons. But can India do something about it? The statement from the Indian finance minister indicates that nothing the government can and should do, not even the RBI. Are people totally at the mercy of the markets and stocks? Not sure, if it is a joke, fact or rumor: heard that the Indian government sees it as a great opportunity for more cash-flow into India, especially from the expatriates and the investors.

Even after devastating tsunami and Fukusima disasters, Japan’s yen is constantly getting better against dollar while its GDP growth rate is near zero. China’s Yuan did not depreciate much either! Yes, economist may say that weak euro may make dollar king by default and weaken rupee. But is this all there is in this story?

Around 1750’s when the British came to India the exchange rate was around 1 Rupee = 2.8 pounds. By the time they left India in 1947, it was 1 pound = 5 rupees. Exchange rate with US dollar was about the same at that time. Basically, they bled the nation’s economy to near death by transferring massive amount of wealth to Great Britain after causing famines and millions of deaths in India. Is the history indicative of some serious wrongs of current crisis period?

As mentioned earlier – there must be innumerable factors behind this fall of rupee today. However a cursory look at one of the key factors -relationship between governance and government and the value of rupee may reveal something we normally don’t think about. Below is the historical data since 1973:

Below are the governments and heads of governments in Delhi, who were in power since 1967:

Earlier, the biggest change in the rupee-dollar equation happened between June 28 and July 4, 1991 when the rupee depreciated by 24% Dr. Manmohan Singh was the finance minister under the leadership of Prime Minister Narasimha Rao, who championed economic liberalization – one may find it to be a strange case.

On the other hand, around April, 2007, rupee appreciated almost 9% from 44.6 down to 40.90. One of

the reasons given for this miracle was close to Rs 7,200 crore (Rs 72 billion) Foreign Institutional Investors (FIIs) investments, which was near 75% of the FII investments that calendar year, between March 5 and April 25.

This history of exchange rates and governance chart above reveals few things:

Indian Rupee fared much better during stable non-Congress governments (1977-80 and 1998 to 2004) after Indira Gandhi’s defeat in 1977. During the periods of short-lived coalition governments it was worse (1990-91 and 1997-98). However, it’s worst after the second term of the UPA government. Obvious questions arise – is the Indian government not doing things right? Has the effect of corruption and the big scandals and accompanying black money added with the inflation causing rupee to get pummeled? Is it true that just like the British did before their departure from India – siphoning out of Indian wealth to Swiss and other banks may have something to do with it? It is a sheer reminder of those volatile political scenes in Delhi in 1990-91 and 1997-98? India’s GDP growth rate has also dwindled from 9.4% in Q1 of 2010 to 7.7% in Q3 of 2011. While most other nations’ rate slowed down significantly, including China and Brazil. Few countries like Indonesia, Russia and South Africa have done a great job though – is there anything to learn from them?

But my final set of questions is eerie! Is anarchy ruling the financial lanes of Indian economy? Is this crisis being exasperated by vested interest groups? First one could be the black-money holders’ for turning those to white – both within and outside Indian borders. The second one may be those who benefits from opening the floodgate of foreign retail and airlines industries by suddenly increasing the foreign investments limits without a national consensus. The co-incidence is definitely suspicious! Are the captains of Indian financial ships unable to perform their tasks? Or they have simply surrendered themselves to some bhagya bidhata? It is perplexing to see this steep fall of rupee while many Indian leaders spoke about an ‘Indian Century’. I’m sure the corruption and internal bleeding of economy has a lot to do with it, but will eagerly wait to hear from some experts some day on this. In the mean time, one can only hope – that this fall of rupee is a temporary one!